Almost every aspect of establishing and managing an Estonian company can be done entirely online from anywhere. We say almost because things get a bit tricky when you want to add a shareholder to your private limited company. Adding a new director is already very easy if that person is an e-resident who can make a digital signature.

Traditionally, transferring shares in an Estonian OÜ required a notary, and in many cases this is still the default legal route in 2026. There are also two novel ways to transfer shares in an Estonian company, but these methods both have limitations too. Fortunately, there’s also a little-known trick that enables you to add a new shareholder online for your Estonian limited company without having to transfer any existing shares at all. The new shareholders don’t even need to have an Estonian digital ID.

So we put together this up-to-date guide with everything you need to know about how to add a new shareholder for an Estonian limited company.

Quick summary

In most cases, adding a shareholder to an Estonian OÜ still requires either a notary or issuing new shares.

For e-residents, issuing new shares online remains the most practical option when conditions are met.

The standard ways to add a shareholder to your limited company

If you want to bring in a new co-owner then most Estonian company owners, until now, have had to arrange offline notary appointments to transfer shares. That needs to be done in Estonia with all shareholders present, which comes with both hassle and cost. This remains inconvenient for e-residents and foreign shareholders, especially when parties are located in different countries.

If a shareholder can’t attend the notary meeting, the only alternative has been through the use of ‘power of attorney’. This will save a trip to a notary in Estonia, but it’s still just another layer of hassle and expense to involve a business services provider, in addition to a notary. You’ll probably need to pay for a foreign notary too because documents from most countries will need to be apostilled by the designated authority.

The notary fees in Estonia are regulated by law and are quite low for small share transfers, but this also means that Estonian notaries do not want to perform these cheap transactions with foreigners. This means that you could wait a month to get an appointment.

Why is adding or transferring shares still not fully digital in Estonia?

Estonia is widely recognised as a digital nation, where most government services are available online and digital ID is used for authentication and legally binding signatures. However, certain legal actions are still deliberately kept under stricter control. These include marriage, divorce, real estate transactions, and the transfer of company shares.

This is not due to a lack of technology. Rather, Estonian law treats these actions as high-impact legal decisions that affect ownership, property rights, and long-term obligations. For share transfers in particular, the state applies an additional layer of protection to reduce the risk of coercion, fraud, or disputes. For this reason, notaries play a central role. A notary is an independent public official acting on behalf of the state, responsible for verifying intent, identity, and legal correctness. Notaries are also required to carry professional indemnity insurance to cover potential damage arising from wrongful transactions.

While Estonia continues to expand digital solutions year by year, the legal principle behind notarisation of share transfers remains unchanged in 2026. As a result, adding a shareholder to an Estonian OÜ still involves either a notary or one of the legally accepted alternatives described below.

Four alternative ways of adding new shareholders to a limited company

1. Using an e-notary

Estonian notaries have launched an e-notary service so that e-residents can transfer shares to another e-resident online, instead of at a notary office in Estonia. You can read more about this on the e-Residency blog here.

All other aspects of the process remain the same so you will still need to book and pay for a notary, but at least you don’t have to fly to Estonia or get an attorney involved.

You can choose a notary by logging in with your digital ID at notar.ee. Don’t worry too much about which one to choose, as long as they can conduct the transaction in English and are happy to use an e-notary. Notary fees are regulated by law and they all provide the same good quality of service.

You would need a good internet connection for video streaming and a web camera for biometric facial recognition by Estonian verification startup Veriff. So this will help all e-residents around the world, but not everyone. Getting an appointment may be problematic if you are in a hurry.

In 2026, the e-Notary solution works only when all parties can be reliably identified and are accepted by the notary, which in practice still limits its use in cross-border shareholder changes.

2. Managing your shareholder list

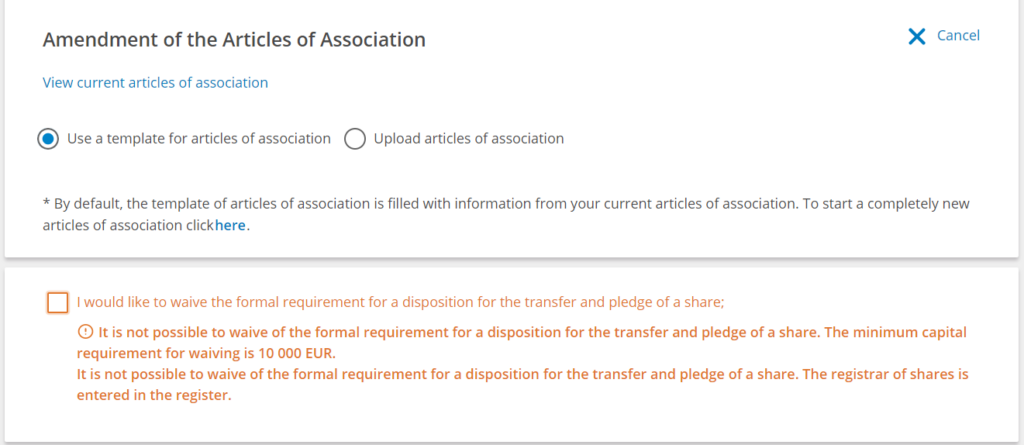

The Estonian Parliament recently changed the law at the request of the startup sector so that shares can now be transferred to a new shareholder at the responsibility of the parties involved if the company’s articles of association approve this. This can only be added to the articles of association if it is unanimously agreed by all existing shareholders.

The law came into force on 1 August 2020.

However, for this to work your company will need to have a share capital of at least €10,000 that has been fully paid and registered before you waive the requirement for a notary. In practice, this option is rarely available to e-resident companies, as it requires fully paid share capital of at least €10,000 and prior amendments to the articles of association. That helps grow startups, but for most micro-companies and single-founder OÜs, this option is not applicable.

This is similar to the historical trust-based system already used in other EU jurisdictions, such as the UK and Sweden. The Estonian version is safer though as unauthorized people cannot send fake hand-signed paper documents to the register. All is done online with a clear track record of the steps taken by the management board. Updating the shareholder list on the register is free.

However, what if you don’t have a share capital of €10,000 paid in, but still want to add a shareholder to a limited company?

3. Using NASDAQ CSD

This solution is typically used by scale-ups and investment-backed companies rather than standard e-resident businesses. Your company can register its shares with Nasdaq CSD, as an alternative to the Estonian Business Register managing your shareholder list. The monthly fee for the maintenance of shares worth up to 80,000 euros in nominal value would be 10 euros plus VAT per calendar quarter. There are also some minor registration fees when switching to CSD service.

Nasdaq CSD is the regional central securities depository (CSD) with a business presence in Estonia, Iceland, Latvia and Lithuania. They manage the shareholder lists of listed stock companies and other companies wishing to use their services.

The restriction here though is that all the shareholders need to have a securities account at an Estonian bank. That can be a tricky requirement for even the most experienced venture capital fund investors if they are non-residents. It also still requires a trip to Estonia to open the initial account at that bank before applying for the securities account. Estonian startups have lobbied to change this requirement, but have had no success so far.

So what if your new shareholder doesn’t have an Estonian securities account and none of the other options are suitable for you? Well, there is one more option that we’ve discovered.

4. The simplest way to add shareholders for your limited company

There’s one more way to add a new shareholder to your Estonian company and it’s surprisingly simple. We like to keep things simple here at Unicount so we’ve done it ourselves multiple times with our own businesses and we are aware that it is the standard way for Estonian startups to raise capital.

It works because you don’t actually transfer any existing shares to your new shareholder. You simply issue new shares online directly to them instead. This involves no notary and no attorney.

As outlined in Estonia’s Commercial Code, you will need to produce a digitally signed shareholders’ resolution that outlines the planned new share allocation with the details of all the shareholders. You do not need proof of their payment of up to €50 000 from your company’s banking service provider. Please note that the added shareholders should not make the payments before the shareholder resolution gets signed, as some registry department clerks may find it to be a wrong sequence of events. The proof for payment over that threshold should be a digitally signed deposit certificate as described in our article “How to register share capital of your Estonian company“. Also, you cannot issue any new shares before your minimum share capital of 2,500 euros is paid up and registered as described in the linked article. As of 2026, issuing new shares is only possible once the minimum share capital has been fully paid and registered.

If your articles of association specify an exact registered share capital amount (as is in standard articles) then you might want to make this more flexible, such as ‘€2,500 to €10,000’. This will enable you to repeat this share-issuing process again in future by adding a new shareholder without having to submit the changed articles to the Business Register too. Two important legal requirements to note are that your minimum capital should be in a ratio of 1⁄4 to maximum share capital. In practice, courts now consistently expect the articles of association to explicitly allow share premium (agio) if new shares are issued above nominal value.

Premium is very useful when you value your company above the nominal value of your share and the new shareholder also agrees to pay more than the nominal value of the new share issued. Anything above the nominal (face) value would be treated as a premium instead of the registered share capital. This is very handy if your company is a startup with losses that have reduced the company equity below the registered share capital. So just bear in mind that this would not help you when you just want to sell your shares for profit as the premium would stay in the company as equity.

For example, let’s say you are the sole shareholder of a company with a minimum share capital of €2,500 and you want to sell 20% of your company to a new partner. You don’t need to transfer 20% of your share. Instead, you can decide to issue a new share with a nominal value of 625 euros and mark your business partner as the new shareholder. After you have digitally signed the shareholder resolution that person/company will then make their payment of the required nominal or nominal plus premium amount into your business account before you can register the new shareholder with Business Register.

You can then log into the e-Business Register, alter the share capital amount and shareholders list, and submit it with shareholder resolution and bank certificates. This is then processed by the Tartu County Court registration department which will check that this process has been done correctly and update the public data in the Business Register to make it official.

Here’s an interesting thing about this method. Only the existing shareholders need to digitally sign the shareholder resolution. Unlike selling shares at a notary, the court does not expect people who have been issued new shares to present any written consent, representation right documents or notarised registration certificates for legal persons becoming your shareholders.

That means you can add a shareholder to your limited company even if they do not have an Estonian digital ID. The new partners would only need to make a digital signature on future shareholder resolutions if required under the rules of the company’s articles of association or Commercial Code and subject to the amount of their nominal shareholding. For example, amending the standard articles of association usually requires approval from two-thirds of shareholders so two 50% of shareholders would need to have digital ID cards for that. The annual report just has to be signed off by one director (member of the board) though. Even if a digital ID card isn’t needed, we’d always advise non-resident shareholders to apply for e-Residency for its long-term benefits, especially if you are going to be a substantial co-owner of an Estonian company, but at least you wouldn’t be held back by waiting to get your e-resident card.

Just one last issue…

One practical requirement remains unchanged in 2026: documents submitted to the Estonian Business Register must be in Estonian.

So, since publishing this article, we’ve written up a free template for you to use. It’s in Estonian but has guidance in English about how to use it. You can download it here. If you would like to get some help from Unicount contact us and we will organize the process for a fee subject to an hourly rate.

What if I want to buy or sell an entire Estonian company?

Finally, this subject also comes up a lot in the e-resident community as people seek to buy Estonian companies. In most cases, buying an existing Estonian company is not recommended for e-residents.

The main motive for buying an existing company among e-residents is to get hold of an existing bank account or licence that the company may have too, such as a licence to trade crypto. This isn’t advisable because both of those things are issued to the company dependent on factors that include an assessment of the business model, clients, shareholders, beneficial owners and board members. If any of these details change then both the bank account and license can be withdrawn (as often happens in these circumstances).

Fortunately, it’s so simple to set up a limited company online that there is little to be gained from trying to buy one from someone else. You can then apply for banking and licenses that are available based on your circumstances.

Selling your dormant company can be an alternative to liquidation, which is a cumbersome and expensive process in Estonia. Your main problem would be finding a buyer who would agree to take over your company based on your statements. It is a risk for the buyer clearly so you cannot expect to get any profit, but you may get your formation fees back at best.

Thanks for reading

Unicount is the simplest way to register a paperless EU company in Estonia, whether you are a citizen, resident or e-resident of Estonia.

Our service is available for people setting up a company with a single shareholder and director due to API limits from the Estonian Business Register. If you want to add a shareholder to a limited company, we recommend that you use the e-Business Register. However, you’d still need a registered office address and contact person so you can first sign up for Unicount’s virtual office subscription here then follow this guide for using Unicount’s address and contact person when registering a company through the e-Business Register.

Unicount supports e-residents throughout the lifecycle of their Estonian OÜ, from formation to shareholder changes and ongoing compliance.

If you are planning to add a shareholder and want to choose the most efficient and legally correct option for your situation, our team can review the setup and guide you through the process.